One of the most common business phenomena is also one of the most perplexing: when successful companies face big changes in their environment, they often fail to respond effectively. Unable to defend themselves against competitors armed with new products, technologies, or strategies, they watch their sales and profits erode, their best people leave, and their stock valuations tumble. Some ultimately manage to recover—usually after painful rounds of downsizing and restructuring—but many don’t.

Why do good companies go bad? It’s often assumed that the problem is paralysis. Confronted with a disruption in business conditions, companies freeze; they’re caught like the proverbial deer in the headlights. But that explanation doesn’t fit the facts. In studying once-thriving companies that have struggled in the face of change, little evidence of paralysis was found. Quite the contrary. The managers of besieged companies usually recognize the threat early, carefully analyze its implications for their business, and unleash a flurry of initiatives in response. For all the activity, though, the companies still falter.

The problem is not an inability to take action but an inability to take appropriate action. There can be many reasons for the problem—ranging from managerial stubbornness to sheer incompetence—but one of the most common is a condition that is called active inertia. Inertia is usually associated with inaction—picture a billiard ball at rest on a table—but physicists also use the term to describe a moving object’s tendency to persist in its current trajectory. Active inertia is an organization’s tendency to follow established patterns of behavior—even in response to dramatic environmental shifts. Stuck in the modes of thinking and working that brought success in the past, market leaders simply accelerate all their tried-and-true activities. In trying to dig themselves out of a hole, they just deepen it.

Because active inertia is so common, it’s important to understand its sources and symptoms. After all, if executives assume that the enemy is paralyzed, they will automatically conclude that the best defense is action. But if they see that action itself can be the enemy, they will look more deeply into all their assumptions before acting. They will, as a result, gain a clearer view of what really needs to be done and, equally important, what may prevent them from doing it. And they will significantly reduce the odds of joining the ranks of fallen leaders.

The Four Hallmarks of Active Inertia

To understand why successful companies fail, it is necessary to examine the origins of their success. Most leading businesses owe their prosperity to a fresh competitive formula—a distinctive combination of strategies, processes, relationships, and values that sets them apart from the crowd. As the formula succeeds, customers multiply, talented workers flock to apply, investors bid up the stock, and competitors respond with the sincerest form of flattery—imitation. All this positive feedback reinforces managers’ confidence that they have found the one best way, and it emboldens them to focus their energies on refining and extending their winning system.

The fresh thinking that led to a company’s initial success is often replaced by a rigid devotion to the status quo.

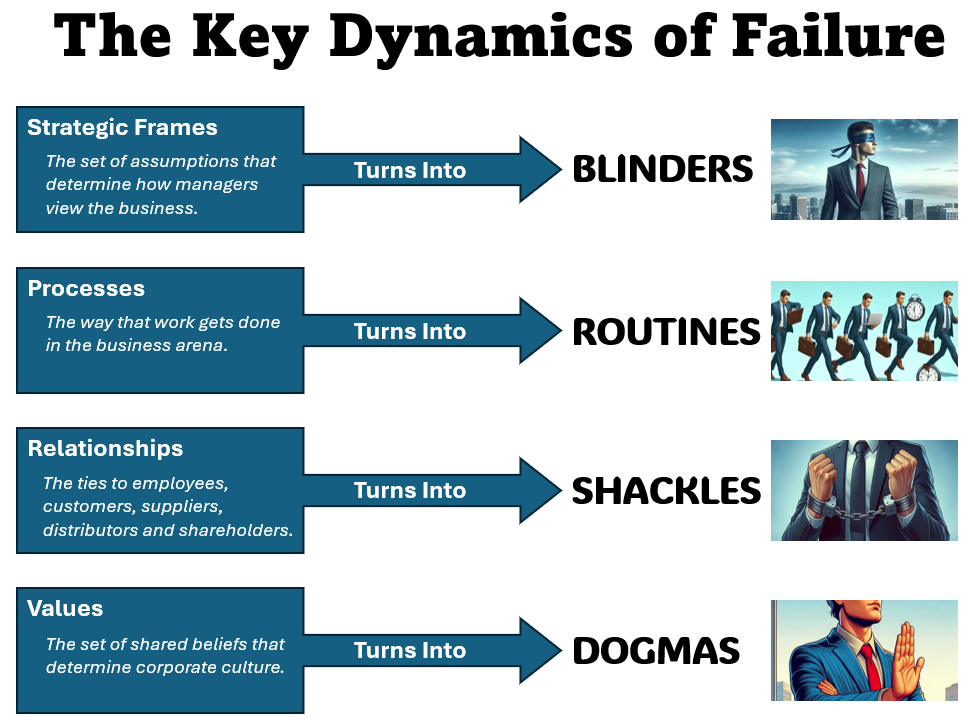

Frequently, though, the system begins to harden. The fresh thinking that led to a company’s initial success is replaced by a rigid devotion to the status quo. And when changes occur in the company’s markets, the formula that had brought success instead brings failure. In particular, four things happen:

Strategic Frames become Blinders

Strategic frames are the mental models—the mind-sets—that shape how managers see the world. The frames provide the answers to key strategic questions: What business are we in? How do we create value? Who are our competitors? Which customers are crucial, and which can we safely ignore? And they concentrate managers’ attention on what is important among the jumble of raw data that crosses their desks and computer screens every day. The frames also help managers see patterns in complex data by fitting the information into an established model.

But while frames help managers to see, they can also blind them. By focusing managers’ attention repeatedly on certain things, frames can seduce them into believing that these are the only things that matter. In effect, frames can constrict peripheral vision, preventing people from noticing new options and opportunities. As a strategic frame grows more rigid, managers often force surprising information into existing schema or ignore it altogether.

Sadly, the transformation of strategic frames into blinders is the rule, not the exception, in most human affairs. Consider the disastrous evolution of France’s military strategy during the first half of this century. At the turn of the century, French military doctrine glorified attack, reflecting a belief that élan vital would prevail over all odds. But the attack-at-all-costs strategy proved disastrous in the trenches of World War I. As a result, the country’s military changed its strategic frame and adopted a purely defensive posture, which took concrete form in the Maginot Line, a series of fixed fortifications erected to protect France’s borders from German invasion. These fixed defenses, however, proved worthless in halting blitzkrieg attacks. The hard-won lesson from the First World War became a tragic blinder during the Second.

When strategic frames grow rigid, companies, like nations, tend to keep fighting the last war. When Xerox’s management surveyed the competitive battlefield in the 1970s, it saw IBM and Kodak as the enemy, its 40,000 sales and service representatives as its troops, and its patented technologies as its insurmountable defenses. Xerox’s frames enabled the company to fight off traditional foes using established tactics and to rebuff repeated attempts by IBM and Kodak to attack its core market. But the strategic frames blinded Xerox to the new threat posed by guerrilla warriors such as Canon and Ricoh, which were targeting individuals and small companies for their high-quality compact copiers.

Once Xerox’s management recognized the magnitude of the threat from the new entrants, it belatedly but aggressively launched a series of quality programs designed to beat the Japanese at their own game. These initiatives did stem Xerox’s share loss, and the company’s victory over the Japanese was trumpeted in books with titles like Xerox: American Samurai. The focus on beating the Japanese, however, distracted Xerox’s management from the emerging battle for the personal computer. At the time, Xerox’s Palo Alto Research Center was pioneering several of the technologies that sparked the personal computer revolution, including the graphical user interface and the mouse. But Xerox was unable to capitalize on the new opportunities because they lay outside its strategic frames.

Processes harden into Routines

When a company decides to do something new, employees usually try several different ways of carrying out the activity. But once they have found a way that works particularly well, they have strong incentives to lock into the chosen process and stop searching for alternatives. Fixing on a single process frees people’s time and energy for other tasks. It leads to increased productivity, as employees gain experience performing the process. And it also provides the operational predictability necessary to coordinate the activities of a complex organization.

But just as with strategic frames, established processes often take on a life of their own. They cease to be means to an end and become ends in themselves. People follow the processes not because they’re effective or efficient but because they’re well known and comfortable. They are simply “the way things are done.” Once a process becomes a routine, it prevents employees from considering new ways of working. Alternative processes never get considered, much less tried. Active inertia sets in.

McDonald’s is another example of a company whose routines have dulled its response to shifting market conditions. In the early 1990s, the fast-food giant’s operations manual comprised 750 pages detailing every aspect of a restaurant’s business. For years, the company’s relentless focus on standardized processes, all dictated by headquarters, had allowed it to rapidly roll out its winning formula in market after market, ensuring the consistency and efficiency that attracted customers and dismayed rivals.

By the 1990s, however, McDonald’s was in a rut. Consumers were looking for different and healthier foods, and competitors such as Burger King and Taco Bell were capitalizing on the shift in taste by launching new menu items. McDonald’s, however, was slow to respond to the changes. Its historical strength—a single-minded focus on refining its mass-production processes—turned into a weakness. By requiring menu decisions to pass through headquarters, the company stifled innovation and delayed action. Its central development kitchen, removed from the actual restaurants and their customers, churned out a series of products, such as the McPizza, McLean, and Arch Deluxe, but they all failed to entice diners.

Relationships become Shackles

In order to succeed, every company must build strong relationships—with employees, customers, suppliers, lenders, and investors. When conditions shift, however, companies often find that their relationships have turned into shackles, limiting their flexibility and leading them into active inertia. The need to maintain existing relationships with customers can hinder companies in developing new products or focusing on new markets.

Managers can also find themselves constrained by their relationships with employees, as the saga of Apple Computer vividly illustrates. Apple’s vision of technically elegant computers and its freewheeling corporate culture attracted some of the most creative engineers in the world, who went on to develop a string of smash products including the Apple II, the Macintosh, and the PowerBook. As computers became commodities, Apple knew that its continued health depended on its ability to cut costs and speed up time to market. Imposing the necessary discipline, however, ran counter to the Apple culture, and top management found itself frustrated whenever it tried to exert more control. The engineers simply refused to change their ways. The relationships with creative employees that enabled Apple’s early growth ultimately hindered it from responding to environmental changes.

Banc One is another company that was hamstrung by its relationships with employees—in particular, its managers. Growing from humble beginnings, Banc One became the most profitable U.S. bank in the early 1990s, with a market capitalization that topped that of American Express and J.P. Morgan. Its formula for success was to acquire healthy local banks, retain their incumbent managers, and grant those managers considerable autonomy in running their businesses. These “uncommon partnerships,” as Banc One dubbed the relationships, motivated the managers to act as entrepreneurs and respond to local market conditions.

But as consolidation and deregulation changed the banking industry, Banc One began to struggle. Many of its best customers were being stolen by aggressive new competitors like Fidelity Investments, and the high cost of its decentralized, locally focused operations put it at a disadvantage to more efficient rivals like First Union and NationsBank. Banc One was slow to standardize its products and centralize its back-office operations because it knew that such moves would curb the autonomy of the local bank managers. It regained its upward momentum only after its CEO decided to abandon the cherished uncommon partnerships altogether.

Relationships with distributors can also turn into shackles. Dell Computer has surged ahead of rival PC makers by selling directly to customers. Incumbents like Hewlett-Packard and IBM have been slow to copy Dell’s model, fearing a backlash from the resellers who currently account for the vast majority of their sales. Airlines like Lufthansa, British Airways, and KLM face a similar dilemma. They’ve been slow to promote direct sales—over the Internet, for example—because they don’t want to antagonize the travel agents they rely on for filling seats.

Values harden into Dogmas

A company’s values are the set of deeply held beliefs that unify and inspire its people. Values define how employees see both themselves and their employers. As companies mature, however, their values often harden into rigid rules and regulations that have legitimacy simply because they’re enshrined in precedent. Like a petrifying tree, the once-living values are slowly replaced by the cold stone of dogma. As this happens, the values no longer inspire, and their unifying power degenerates into a reactionary tendency to circle the wagons in the face of threats. The result, again, is active inertia.

Polaroid’s steady decline illustrates how once-vibrant values can harden. Founded by inventor Edwin Land, Polaroid rose to prominence by pioneering a series of exciting technologies like instant photography, and its employees prided themselves on the company’s R&D leadership. But over time, Polaroid’s devotion to excellent research turned into a disdain for other business activities. Marketing and finance, in particular, were considered relatively unimportant so long as the company had cutting-edge technology. Valuing technological breakthroughs above all else, Polaroid’s managers continued to invest heavily in research without adequately considering how customers would respond. Not surprisingly, sales stagnated. Today the company is worth only one-third of what a bidder offered in an acquisition attempt in 1989.

Royal Dutch/Shell is another company whose values became a hindrance. During the 1930s, Shell was dominated by Henri Deterding, who was a strong leader and a Nazi sympathizer. Shell’s other executives finally forced Deterding out, and the painful episode imprinted on the company a distaste for central control—a value that came to permeate its culture and led to the establishment of fiercely independent country managers. The decentralized structure enabled Shell to seize growth opportunities around the world. But when oil prices fell during the 1990s, the belief in decentralized authority prevented the company from quickly rationalizing its operations and cutting costs.

Renewal, Not Revolution

Success breeds active inertia, and active inertia breeds failure. But is failure an inevitable consequence of success? In business, at least, the answer is no. Successful companies can avoid—or at least overcome—active inertia. First, though, they have to break free from the assumption that their worst enemy is paralysis. They need to realize that action alone solves nothing. In fact, it often makes matters worse. Instead of rushing to ask, “What should we do?” managers should pause to ask, “What hinders us?” That question focuses attention on the proper things: the strategic frames, processes, relationships, and values that can subvert action by channeling it in the wrong direction.

Most struggling companies have a good sense of what they need to do. They have stacks of reports from inside analysts and outside consultants, all filled with the same kinds of recommendations. The problem is usually the lack of a clear understanding of how their old formulas for success would hinder them in responding to the changes.

Even after a company has come to understand the obstacles it faces, it should resist the impulse to rush forward. Some business gurus exhort managers to change every aspect of their companies simultaneously, to foment revolution within their organizations. The assumption is that the old formulas need to be thrown to the wind—and the sooner, the better. But the veterans of change programs argue against that approach. They say that by trying to change everything all at once, managers often destroy crucial competencies, tear the fabric of social relationships that took years to weave, and disorient customers and employees alike. A revolution provides a shock to the system, but the shock sometimes proves fatal.

In Summary

Guiding a company through big changes requires a difficult balancing act. The company’s heritage has to be respected. The areas that must be focused on to weave through the quagmire of decisions are areas such as the lack of good leadership, weak or nonexistent communication, inconsistent promises, bad reviews, poor reputation, and unfriendly or overly competitive workplace.

The active inertia can be curtailed but all sides must be taken into account. A strategy does need to be developed with both the future and the past taken into consideration. In other words, a health balance. Don’t make the mistakes of the companies noted above.